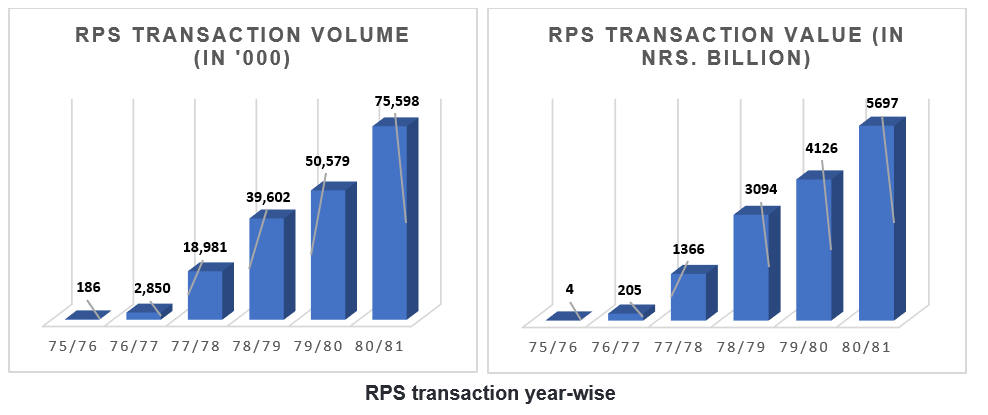

RPS as part of the National Payment Switch (NPS) after its implementation from December 2021, crossed NRs 673 Billion transaction in Asar 2081 (Mid July 2024), with 38% year on year (YoY) growth in transaction value. The transaction volume (number of transaction) has also seen growth of over 49%. This marks the four consecutive months when the transaction in the RPS has exceeded NRs 500 Billion, which was NRs 568 in Mid-June, NRs 527 in Mid May 2024 and NRs 517 in Mid-April 2024. The total transaction value of RPS during the fiscal year 2080/81 (2023/24) has reached NRs 5,697 Billion.

RPS transaction year-wise

As per the recent NRB’s Payments Indicator data, RPS transaction value has surpassed transactions of all retail payment systems including electronic cheque clearing, interbank payment system, mobile banking and cards. Since December 2021, after dis-integration of connectIPS into separate channel and Retail Payment Switch (part of NPS), transaction volume and value has seen growth of over 4 folds, indicating a major shift of payments towards cashless and digital payments transactions.

What is RPS?

connectIPS system was initially implemented in 2017 as faster payment system for Nepal to cater to real-time retail payments through mobile, web and gateway channels. This was later dis-integrated as part of the National Payment Switch (NPS) and the RPS went live in December 2021 to implement non-card-based retail switch, creating multiple retail instruments and to establish interoperability between multiple instruments and systems in Nepal. RPS enables account to account based real-time transactions, that can be used for transfers and payments from any alternate channels. RPS is connected and used by almost all the stakeholders initiating and processing payments, including banks & financial institutions, payment service providers, payment system operators, remittance companies, insurance companies, capital market players, government entities and similar.